Tata Motors Limited, part of the Tata Group, is India’s leading automobile manufacturer with a diversified portfolio spanning commercial vehicles, passenger vehicles, electric mobility solutions, and luxury brands under Jaguar Land Rover (JLR). The company operates across multiple geographies with strong domestic leadership and a growing global presence. Its innovation focus, commitment to sustainability, and strategic investments in EVs and connected technologies continue to strengthen its competitive position in the evolving mobility landscape.

Overall Group Performance

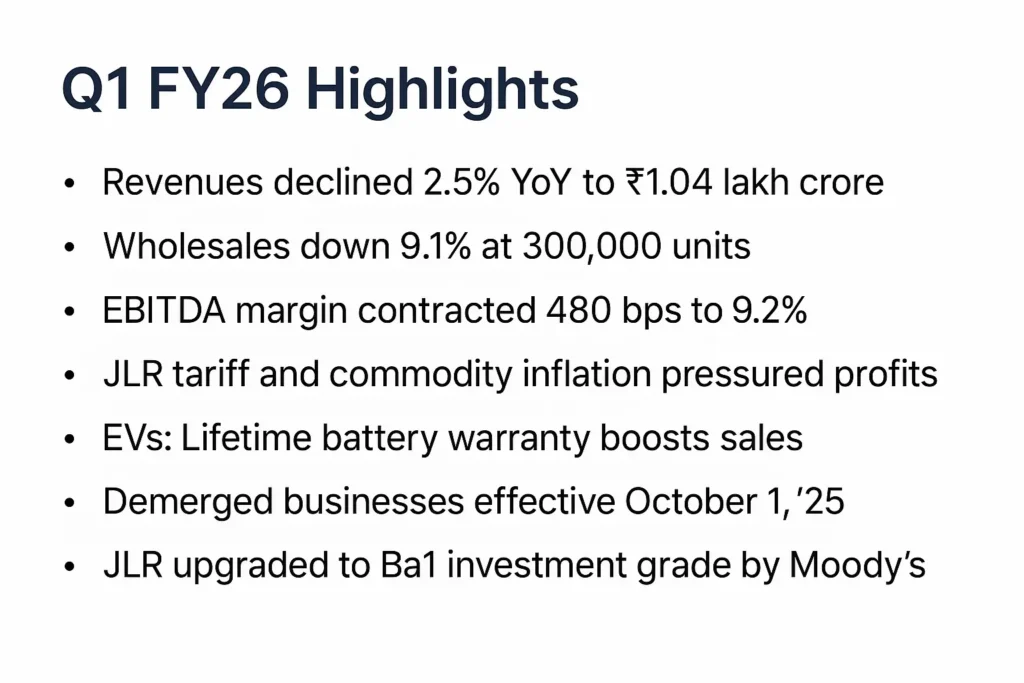

Group CFO P.B. Balaji highlighted that Q1 FY26 was challenging due to macro uncertainties, tariffs, and commodity inflation. Consolidated revenues declined 2.5% YoY to ₹1.04 lakh crore with wholesales down 9.1% at 300,000 units. EBITDA margin contracted by 480 bps to 9.2%, while profit before tax (before exceptionals) stood at ₹5,600 crore. Despite pressure from JLR tariffs and soft PV volumes, CV margins improved, and the domestic business maintained a net cash position. Free cash flow was negative, but management emphasized this was seasonal and expected to normalize in subsequent quarters.

Key corporate actions included the demerger of Tata Motors businesses effective October 1, 2025, and progress on the Iveco acquisition. Additionally, JLR was upgraded to Ba1 investment grade by Moody’s, and Tata Motors introduced lifetime battery warranty on its EVs, which significantly boosted consumer response.

Jaguar Land Rover (JLR)

CFO Richard Molyneux described Q1 as a “challenging but transformative quarter.”

- Financials: Wholesales at 87,000 units, revenue of £6.6 billion, and record revenue per car at £76,000. EBIT margin stood at 4%, with PBT of £351 million. Negative free cash flow of £758 million was driven by US tariffs (£254m impact), dollar weakness, and warranty reserves.

- Market Trends:

- Range Rover & Defender demand remained robust, contributing 77% of volumes.

- Jaguar sales were largely restricted to F-PACE, with other models phased out.

- Regional performance: UK remained stable, North America disrupted by tariffs, Europe impacted by Jaguar decline, China pressured by new luxury tax, and MENA reported strong growth.

- Key Headwinds: US tariffs at 27.5% were fully accounted; negotiations may reduce to 10% under quotas, but uncertainty persists. China’s luxury tax cut-off shift to RMB 900,000 is adding 10% cost burden on nearly all Range Rover sales.

- Strategic Actions: Launched brand campaigns (Range Rover at Wimbledon, Defender with Oasis Tour), initiated a 14-mission transformation program expected to deliver £1.4 billion value (5% EBIT impact). BEV rollout remains on track for 2026, with flexibility to balance ICE and EV production.

Commercial Vehicles (CV)

CFO G.V. Ramanan and ED Girish Wagh reported a resilient quarter despite volume pressures:

- Financials: Revenues declined 4.7% YoY, but EBITDA margin rose to 12.2% and EBIT to 9.7% aided by cost savings and improved realizations. ROCE was strong at 39.6%.

- Segment Performance:

- Market share improved 50 bps QoQ to 36.1%.

- HCV volumes declined due to regional factors (Bangladesh trade impact, “Operation Sindoor” in North India, and early monsoon slowing tippers).

- ILMCV grew, supported by manufacturing and perishables transport.

- SCV stabilized at lower levels, but the new ACE Pro launch is expected to revive volumes.

- Buses & Vans grew 12% YoY; Tata Motors emerged as L1 bidder for India’s first 18-meter articulated electric bus project with flash-charging technology.

- Digital & Mobility Initiatives: Fleet Edge subscriptions rose sharply; E-Dukaan onboarded 9,000+ customers; FleetVerse enabled 10,000+ direct retail sales. Digital leads contributed 28% of Q1 retail sales.

- Outlook: Q2 expected to improve on a low base with festive season and infrastructure-driven demand. Focus remains on sustaining double-digit margins and market share gains.

Passenger Vehicles (PV) & Electric Mobility

CFO Dhiman Gupta and MD Shailesh Chandra highlighted soft demand, transitionary pressures, but strong EV traction:

- Financials: PV volumes fell 10% YoY, leading to lower revenues and margin pressure. ICE margins were squeezed due to high discounts, weak operating leverage, commodity inflation (steel safeguard duty), and adverse model mix. EV margins, however, improved YoY even without PLI benefits.

- EV Business:

- Steady volumes (~5,500 units/month) through FY25 saw a revival in June–July 2025, with Tata’s EV market share rebounding to 40% in July.

- The Harrier.ev launch was a blockbuster, with 10,000 bookings on day one and strong pipeline visibility. Lifetime battery warranty for Nexon.ev and Curvv.ev significantly boosted bookings (Nexon.ev July bookings up 55% QoQ).

- Portfolio Actions:

- New AdventureX variants of Harrier & Safari launched at competitive pricing.

- Tiago & Altroz reported strong bookings (+22% YoY in June).

- Strong festive campaigns planned to improve demand and mix.

- PLI Benefits: ~₹115 crore recognized in Q1; full-year PV PLI accrual expected at ~₹700 crore.

- Outlook: Expect EV share of PV portfolio to rise to 17% in Q2, with margins improving through cost reductions, PLI accrual, and premium EV launches.

Outlook & Strategy

- Global demand remains uncertain; tariffs, commodity costs, and China’s luxury tax are risks.

- Domestic demand expected to recover with lower interest rates, festive momentum, and rural demand revival.

- Focus on disciplined investments, channel inventory health, and execution across verticals.

- Management reiterated commitment to profitable growth, double-digit margins in CV, improved EV mix in PV, and JLR EBIT of 5–7% for FY26.

Question & Answer Session Highlights

Q: How has Tata Motors accounted for US tariffs, and is a rollback possible?

A: JLR accounted tariffs at a flat 27.5% for Q1. There is a chance of rollback to 10% from May 8 under government agreements, but it is not yet enacted, so not booked. Tariffs are shown in cost of sales. Mitigation includes reducing sales allowances, taking price hikes on MY25/26 Range Rovers, and leveraging CAFE fine relief (£120m release).

Q: What is the EBITDA margin outlook for PV, and how are EV rare-earth supply issues being managed?

A: PV margins will remain pressured for 1–2 quarters but expected to recover to double digits within 2–3 quarters with better mix, cost actions, and festive demand. EV profitability is improving. Rare-earth sourcing is secured for 2–3 months; alternatives beyond China are being developed.

Q: Why has CV demand weakened despite high fleet utilization?

A: Utilization remains healthy, but early monsoon, delayed government project payments, and postponement of fleet purchases impacted volumes. Buses and vans performed well, but SCV segment remains stressed.

Q: Outlook on CAFE 3 guidelines and PV industry growth for FY26?

A: No timeline extension expected; only stringency levels under discussion. PV industry growth for FY26 expected below 5%, with recovery in H2 driven by lower interest rates, rural demand post-monsoon, and festive season.

Q: What is the status of EV launches and demand recovery?

A: Harrier.ev launched strongly with 10,000 bookings on day one. Sierra is on track for H2 FY26. Nexon.ev and Curvv.ev demand surged after lifetime warranty announcement. EV share in PV expected to cross 17% in Q2.

Q: What are the margins and PLI accruals in CV and PV?

A: CV PLI accrual was ₹25 crore in Q1, expected to rise with bus volumes. PV PLI accrual at ~₹115 crore in Q1, expected at ~₹700 crore for FY26.

Q: What explains Harrier.ev’s strong customer response?

A: Superior performance (500 km real range, high torque), advanced features (540° camera, Dolby audio, auto-park summon), and price parity with ICE SUVs made it highly desirable.

Q: Will Tata Motors participate in the upcoming CESL 10,900 e-bus tender?

A: Yes, as the new tender addresses payment security and asset-light concerns. Tata Motors will form consortiums with operators and financiers for participation.

Q: JLR BEV rollout and China demand outlook?

A: Range Rover/Defender BEVs will launch in 2026 with uncompromised quality. Jaguar BEVs will follow. In China, the July luxury tax change (threshold cut) adds 10% cost on most vehicles. For now, JLR is absorbing this cost to support fragile dealer networks.

Q: What is the expected impact of reduced EU/UK tariffs?

A: Full-year FY26 tariff impact estimated at £500–600m net. With reductions, perpetual impact expected at £300–400m annually. Demand/pricing response will determine final impact.

Q: How does management view financing and liquidity?

A: JLR secured a £1bn UKEF-backed loan facility to boost liquidity. A $700m bond matures in October. Working capital swings will normalize, and tariff cash outflows will reduce in H2.

Closing Remarks

Tata Motors acknowledged a difficult Q1 but emphasized structural strengths, strong new launches, disciplined financial management, and proactive tariff mitigation. Management expects sequential improvement from Q2 and a stronger H2 led by festive demand, new product rollouts, and improving EV traction, while maintaining a focus on profitability and cash prudence.