India’s real estate market has entered a powerful growth cycle. The combination of urbanization, rising disposable incomes, declining interest rates, and government policy support has driven housing demand to new highs. Within this vibrant sector, four companies dominate investor conversations – DLF, Godrej Properties, Lodha Developers, and Oberoi Realty. Each has a unique strategy, footprint, and financial profile.

The recently announced Q1 FY26 earnings shed light on how these real estate majors are navigating the cycle, balancing growth with financial prudence, and preparing for the next phase of India’s real estate boom. Here’s a deep dive into their performance and prospects.

DLF: The Market Leader with Strong Balance Sheet and Rentals Muscle

DLF, the country’s largest real estate player, continues to prove why scale matters in this business. In Q1 FY26, the company posted sales bookings of ₹11,425 crore, a massive 78% jump year-on-year. This stellar performance was powered by blockbuster launches like the Privana ecosystem and strong traction in Mumbai.

Financial performance remained robust with revenues of nearly ₹2,981 crore, EBITDA of ₹628 crore, and profit after tax (PAT) of ₹766 crore, marking a 19% year-on-year rise. Even though gross margins slipped to 28% due to a shift in product mix, DLF’s embedded margins remain extremely healthy. The pipeline of premium projects ensures that margin stability will return in coming quarters.

On the balance sheet, DLF continues to impress. The company generated a net cash surplus of over ₹1,100 crore and reduced debt by ₹1,364 crore in the quarter. The focus remains on net cash generation and gross margin expansion – two metrics that highlight financial discipline in a sector often criticized for over-leverage.

Where DLF truly stands apart is its annuity portfolio through DCCDL. With 46 million square feet of leased assets and an industry-leading 94% occupancy, the company enjoys stable recurring cash flows. Rental income grew 15% year-on-year, with PAT in this segment rising 26%. This rental business provides resilience against residential cyclicality and is a differentiating factor for DLF.

Strengths: Market leadership, robust balance sheet, strong annuity income, aggressive project pipeline.

Risks: Dependence on NCR and Mumbai markets, temporary margin pressures due to product mix.

Godrej Properties: The Aggressive Growth Machine

Godrej Properties (GPL) has been one of the most consistent performers in the sector, riding on brand strength, execution capabilities, and aggressive land acquisition. In Q1 FY26, GPL reported sales bookings of ₹7,082 crore across 4,231 homes with a total area of 6.17 million square feet. While this was 18% lower year-on-year, it still represented a two-year compounded growth of 77%. Importantly, this was the eighth consecutive quarter where bookings crossed ₹5,000 crore – an impressive feat.

The company reported its highest ever quarterly PAT of ₹600 crore, up 15% year-on-year. Revenue stood at ₹1,593 crore (a slight decline of 3%), while EBITDA rose 18% to ₹915 crore. Collections jumped 22% to ₹3,670 crore, underlining strong cash flow visibility.

Godrej’s strategy is clear: expand aggressively into multiple geographies. Bengaluru was the largest contributor in Q1, with projects like MSR City delivering over ₹2,400 crore in sales. Mumbai and NCR also added significant volumes. The company launched six new projects and phases across four cities, with a total sales potential of ₹8,500 crore.

In terms of business development, GPL added five projects with an estimated 9.24 million square feet and a booking value of ₹11,400 crore. Remarkably, this alone accounts for 57% of its annual business development guidance in just the first quarter. The company’s balance sheet remains strong, allowing it to continue aggressive land acquisition.

Strengths: Strong brand, diversified presence across top cities, consistent booking run rate, aggressive land bank expansion.

Risks: Heavy capital requirements for land deals, bookings down year-on-year indicating possible cyclicality.

Lodha Developers: The Balanced All-Rounder

Lodha Developers, also known as Macrotech Developers, has steadily positioned itself as one of the strongest players in Indian real estate. In Q1 FY26, the company achieved presales of ₹4,450 crore, up 10% year-on-year. This marked the sixth consecutive quarter with presales above ₹4,000 crore, establishing a strong base of consistency.

Revenue came in at approximately ₹3,500 crore, reflecting 23% growth, while the embedded EBITDA margin stood at an impressive 33%. The company’s proforma PAT for the quarter was ₹950 crore, translating into a PAT margin of 21% on presales.

What makes Lodha stand out is its financial discipline. Net debt to equity stands at just 0.24x, well below its ceiling of 0.5x. Despite aggressive business development and investments in annuity income, the company has managed to keep leverage in check. Collections during the quarter were about ₹2,900 crore, growing 7% year-on-year.

Lodha is also expanding its footprint strategically. Traditionally dominant in Mumbai, it is now scaling in Pune and Bengaluru, and is preparing to enter the Delhi NCR market by FY27. During Q1 FY26, it added five new projects across Mumbai, Pune, and Bangalore with a combined gross development value (GDV) of ₹227 billion – more than 90% of its full-year guidance achieved in one quarter.

Beyond residential, Lodha is building a strong annuity business in warehousing and industrial leasing. Clients include marquee names like Tesla, DP World, DHL, and Skechers. This diversification provides a new layer of recurring income and enhances resilience.

Strengths: Consistent presales growth, disciplined leverage, diversified strategy across cities and segments, growing annuity business.

Risks: Heavy reliance on regulatory approvals (environmental clearances), concentration in Mumbai region still high.

Oberoi Realty: The Premium Niche Player

Oberoi Realty remains a focused premium developer, known for high-quality projects and margin protection. While smaller in scale compared to peers, the company has built a reputation for prudence and profitability.

In Q1 FY26, Oberoi launched Elysian Tower D at Oberoi Garden City, Goregaon, which received a strong response. It also completed a private equity transaction in I-Ven Realty, adding ₹1,250 crore to its joint venture entity.

On the annuity side, Oberoi’s portfolio is firing on all cylinders. Commerz III, its premium office project, is already 85% leased and expected to hit 100% within FY26. Its malls continue to see strong leasing traction with new stores opening regularly.

The company is also gearing up for its Gurgaon entry and the Adarsh Nagar redevelopment project, both of which will add scale in the coming years. Management reiterated that it maintains strict discipline in land acquisition, ensuring EBITDA margins of 50% or more are sustained.

That said, sales momentum in some ongoing projects has moderated, with unit sales slowing post-launch. Management attributed this to the natural sales cycle, where bookings are strong at launch, plateau in mid-cycle, and pick up again near completion.

Strengths: Premium positioning, very high margins, strong annuity portfolio, prudent land strategy.

Risks: Smaller scale than peers, slower diversification, sales moderation in certain projects.

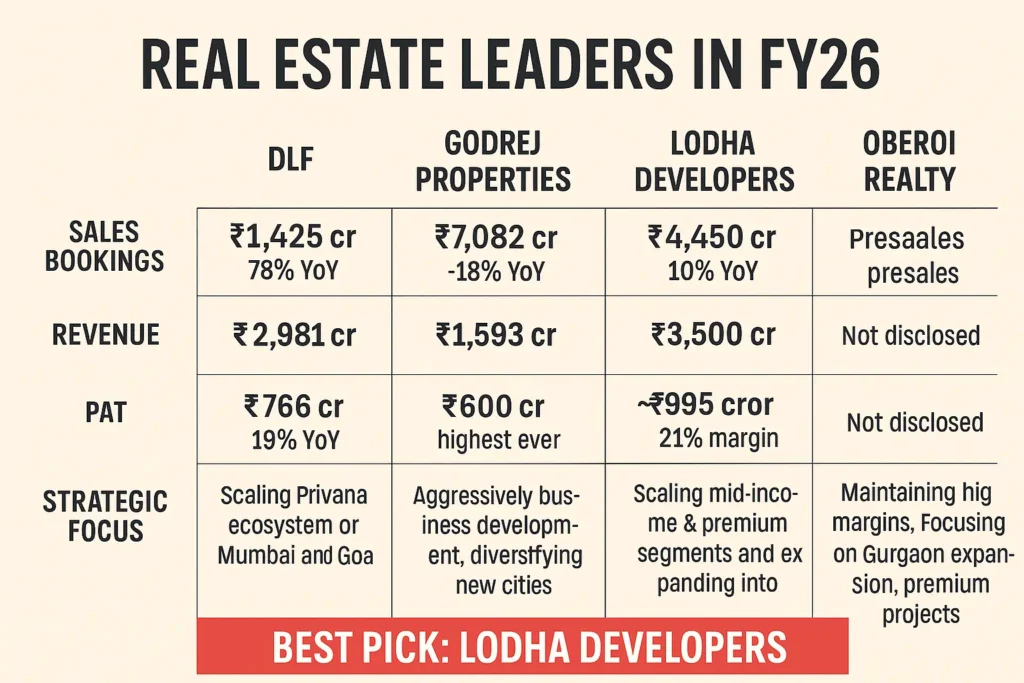

Peer-to-Peer Comparison

- Scale Leader: DLF dominates with the largest presales, strongest balance sheet, and a massive rental business.

- Growth Engine: Godrej Properties is the most aggressive in land acquisition and diversification, offering rapid growth potential.

- Balanced Performer: Lodha combines steady presales, low debt, new market entry, and annuity expansion – a well-rounded proposition.

- Margin Defender: Oberoi Realty focuses on high-margin premium projects and annuity income, but scale remains limited.

Which Stock Should Investors Choose?

The answer depends on the investment style and risk appetite:

- Safety and Scale: Investors seeking a stable, low-risk play with strong recurring income should prefer DLF. Its leadership in NCR, cash generation, and rental portfolio make it a defensive bet.

- High Growth Potential: Those chasing aggressive growth should look at Godrej Properties. With a diversified presence and a pipeline of large projects, it offers rapid expansion, though volatility is higher.

- Balanced All-Rounder: Lodha Developers is the most well-balanced pick. It offers consistent growth, financial discipline, new city entry (NCR), and diversification into annuity businesses. This combination of growth and stability makes it the most attractive option at present.

- Premium Stability: Conservative investors preferring high margins and niche positioning can consider Oberoi Realty, though upside is more limited compared to peers.

Conclusion

The Indian real estate cycle is showing strong momentum, and these four companies are at the forefront of shaping the industry’s future. DLF provides scale and safety, Godrej offers growth, Lodha strikes the best balance, and Oberoi brings premium stability.

For investors looking for the best blend of growth and financial discipline, Lodha Developers emerges as the top pick among the peers. Its consistent presales performance, disciplined leverage, expansion into new markets, and diversification into annuity income make it a compelling choice to ride India’s real estate boom.