Prestige Estates Projects Limited, headquartered in Bengaluru, is one of India’s leading real estate developers with a diversified portfolio spanning residential, commercial, retail, hospitality, and mixed-use projects. Established as a trusted name in urban development, the company has built a strong presence across major cities including Bengaluru, Mumbai, NCR, Hyderabad, and Chennai. Known for timely delivery, premium quality, and large-scale townships, Prestige has transformed into a pan-India developer with an increasing focus on annuity income and sustainable growth.

Prestige Estates Projects Limited began FY26 with its strongest quarterly performance ever, setting a new benchmark in the company’s growth trajectory. Management emphasized that the results reflect both structural demand in Indian real estate and Prestige’s ability to execute large-scale projects across geographies.

1. Record Sales and Collections

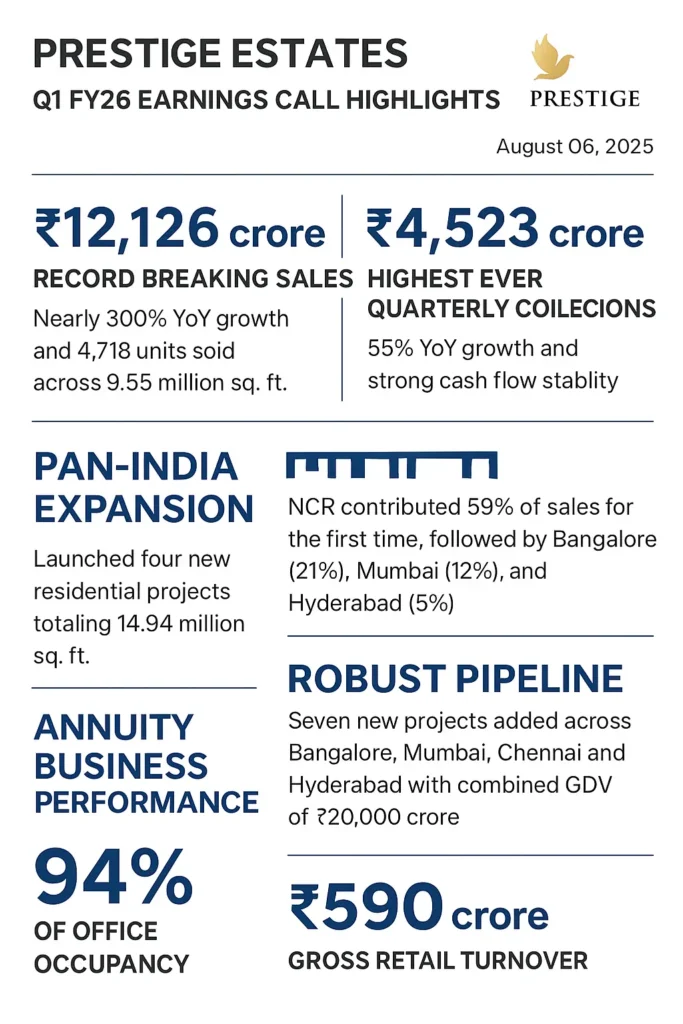

- Sales Performance: The company reported record-breaking presales of ₹12,126 crore in Q1 FY26, nearly 300% YoY growth, the highest ever in its history. This included 4,718 units sold across 9.55 million sq. ft., indicating strong market absorption despite macro uncertainties.

- Collections: Prestige also achieved its highest ever quarterly collections at ₹4,523 crore, up 55% YoY, which underscores the cash flow stability of its business model. The management highlighted that strong collections not only ensure liquidity but also support reinvestment into new land parcels and faster execution.

2. Geographic Expansion – Becoming a Pan-India Player

For the first time, NCR emerged as the largest contributor (59%) to sales, followed by Bangalore (21%), Mumbai (12%), and Hyderabad (5%).

- The launch of Prestige City Indirapuram (NCR) was a game-changer, with 80% inventory sold at launch, showing Prestige’s ability to replicate its township success outside South India.

- This marks a decisive shift in Prestige’s journey from a South India–centric player to a pan-India developer with a balanced sales mix.

3. Launches and Completions

- New Launches: During the quarter, the company launched four new residential projects totaling 14.94 million sq. ft.

- Completions: Prestige delivered 5.45 million sq. ft. across five projects, including its first-ever completions in Mumbai. These were executed in just 3.5 years, reflecting speed and execution excellence.

- Additionally, the completion of Prestige Turf Tower in Mahalaxmi (Mumbai) allows the company to advance the next phase of its flagship mixed-use development, “The Prestige, Mumbai.”

4. Business Development

Prestige added seven new projects across Bangalore, Mumbai, Chennai, and Hyderabad, with a combined GDV (Gross Development Value) of ₹20,000 crore. This replenishes its land bank and provides visibility for sustained growth.

5. Annuity Business (Office & Retail)

- Office Leasing: The office portfolio leased 1.21 million sq. ft. in Q1, maintaining a strong 94% occupancy, with exit rentals at ₹523 crore. The company expects office rentals to reach ₹819 crore exit run rate for FY26.

- Retail Performance: Prestige’s malls recorded ₹590 crore gross turnover in Q1, with 99% occupancy and ₹271 crore exit rentals, highlighting resilience of the retail portfolio.

6. Hospitality Platform and Future Pipeline

- The filing of a DRHP for the hospitality platform is a strategic step to unlock shareholder value and pave the way for growth in that vertical.

- Looking forward, Prestige has a robust launch pipeline across Bangalore, NCR, Mumbai, Hyderabad, and Goa, positioning it for sustained momentum in FY26.

Management reiterated confidence that the strong Q1 foundation, combined with its pan-India presence and diversified portfolio, will ensure Prestige continues its growth trajectory.

Question and Answer Session Highlights

Q1: Presales Guidance

Question: You have guided for presales of ₹26,000 crore in FY26, but Q1 alone delivered ₹12,000 crore. Do you see upside risks to this guidance? What are the launches expected in Q2?

Answer: We are maintaining our guidance of ₹25,000–₹27,000 crore for FY26. In Q2, planned launches include plotted developments like Prestige Greenbrook, Crystal Lawns, and Autumn Leaves in Bangalore; Prestige Highland Park in Mumbai; and the third phase of Prestige City Indirapuram (Mayflower). Approvals are awaited for Evergreen at Prestige Raintree Park (Bangalore).

Q2: Commercial Leasing in Mumbai (BKC Portfolio)

Question: Out of the 9 million sq. ft. leasable area, only 1.5 million is leased. What demand trends are you seeing for the BKC project?

Answer: Demand has been very strong. 50% of the BKC portfolio is already pre-leased, which is rare in Mumbai. However, we are taking a cautious approach and will accelerate leasing closer to project completion (FY27–28) to instill confidence among tenants.

Q3: Jijamata Nagar Development (Mumbai)

Question: Can you elaborate on the product positioning at Jijamata Nagar and expected launch timeline?

Answer: It is a mixed-use development with:

- 1 mn sq. ft. of luxury retail

- 0.5 mn sq. ft. of office space

- A Hilton + Waldorf Astoria hotel and conferencing tower

- Waldorf Astoria branded residences

- Two residential towers for sale.

The launch is dependent on finalizing design and approvals.

Q4: Margins on New Projects

Question: Some slides indicate margins of 52%. Should we assume that as a base case?

Answer: The actual EBITDA margin is ~35%. The 52% figure shown is related to free cash flows, as land costs were already paid earlier.

Q5: Land Acquisitions and Payments

Question: You added projects worth ₹20,000 crore GDV. How much land payment is pending?

Answer: About ₹500 crore remains to be paid. Major projects in Hyderabad and Chennai have staggered payment plans, and some are on revenue-sharing/JDA models with minimal upfront payout.

Q6: Debt Outlook

Question: With heavy capex and business development, where do you expect peak debt by FY27?

Answer: Based on operating cash inflows of ₹18,000–20,000 crore annually, capex of ₹8,000 crore, and BD spends of ₹4,000 crore, we expect debt to rise only modestly by ₹1,000–1,200 crore by FY27.

Q7: Residential Revenue Recognition

Question: Q1 saw completions worth ₹5,500 crore GDV but residential revenue booked was only ₹1,573 crore. Why the gap?

Answer: Revenue recognition occurs upon handover to customers, not just project completion. Handover usually takes 6–9 months. Hence, revenue recognition will catch up in subsequent quarters.

Q8: Future Revenue Visibility

Question: Can we expect ₹15,000–20,000 crore of revenue recognition annually over the next 3–4 years?

Answer: Yes. FY26 residential revenue will be ₹8,000–10,000 crore, rising significantly in FY27 with large project completions. Over the medium term, we see ₹15,000–20,000 crore annual recognition.

Q9: Cash Flow Allocation

Question: With strong free cash flows and a hospitality IPO, how will you allocate capital?

Answer: FY26 will generate ₹7,500–8,000 crore of free cash flow. About ₹3,200 crore will go to capex, and the rest towards business development to replenish inventory. Funding will remain 60% internal accruals and 40% debt.

Q10: Luxury Real Estate Cycle

Question: Given demand for luxury projects, how does Prestige view this cycle?

Answer: Luxury is a niche market with limited buyers. Prestige will selectively target it, ensuring projects are positioned correctly, but will not overexpose to this segment.

Q11: Commercial Annuity Outlook

Question: Why was annuity income projection revised for FY26?

Answer: There is no delay in projects. The presentation now factors in completions scheduled for Q2–Q4 FY26. Hence, exit rentals for FY26 are expected at ₹820 crore, up from earlier guidance.

Q12: IRRs on New Acquisitions

Question: What IRRs do you target for new projects?

Answer: All new acquisitions are benchmarked to 30–35% gross margin and consistent with historical levels.

Q13: Outlook on Bangalore, Hyderabad & Chennai Markets

Question: With IT slowdown, is Bangalore seeing pressure?

Answer: No. Demand remains strong, with plotted, apartment, and township launches performing well.

Question: Why has Hyderabad slowed after a strong launch?

Answer: Sales are steady but not aggressively pushed, as Prestige prefers gradual sales with price increases. Already, 75% of inventory is sold.

Question: What contribution do you expect from Chennai long term?

Answer: Chennai could contribute ₹5,000 crore annually once the project pipeline scales up.

Q14: Execution Risks with Scale-Up

Question: With operations expanding, how do you manage execution risks?

Answer: Prestige engages best-in-class contractors across civil, MEP, elevators, windows, etc., maintaining strong relationships and proven delivery records. Cash flow discipline ensures projects are executed without delays.

Q15: Commercial Real Estate Sentiment & REIT Plans

Question: How is the commercial market outlook? Any REIT plans?

Answer: Demand is strong across India, with limited new supply and robust absorption. Prestige expects exit rentals of ₹3,000–3,500 crore by FY28. A REIT listing (office + retail) is planned in 3–4 years, once critical mass is achieved.

Thanks for sharing this valuable information.