Below is a detailed summary of the management commentary provided by Mr. Karan Yatin Shah, Whole-Time Director – Business Development of Precision Camshafts Limited (PCL), during the Q3 FY ’25 Earnings Conference Call held on February 25, 2025. This commentary is derived from the transcript of the call and reflects the key points made during the opening remarks and the subsequent question-and-answer session.

Opening Remarks by Karan Yatin Shah

- Financial Performance Overview:

- Standalone Results: PCL reported standalone revenue of Rs. 143 crores in Q3 FY ’25, with a net profit of Rs. 5.3 crores, down from Rs. 13 crores in the previous quarter. This decline was attributed to lower sales, reduced other income, and slightly higher operating costs.

- Consolidated Results: Consolidated income decreased by 18% quarter-on-quarter to Rs. 195 crores, driven by sales declines at subsidiaries MFT and EMOSS. Profit before tax was negative at Rs. 4.5 crores, and profit after tax was negative at Rs. 6 crores. The EBITDA margin was 10.83%, with a negative PAT margin of 3%.

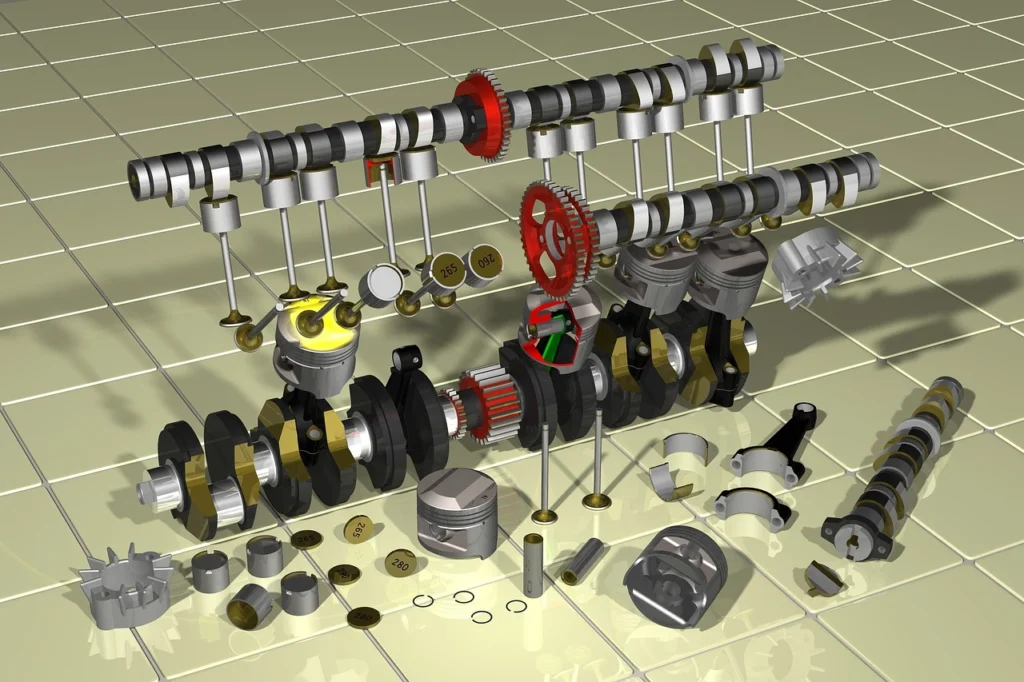

- Camshaft Sales: Quantities of cast and machined camshafts sold decreased by 13% each, reflecting a broader industry slowdown.

- Operational Updates:

- New Manufacturing Plants: Two new plants in Solapur are nearing completion, set to house assembled camshaft facilities and electric vehicle (EV) production lines. Serial production of assembled camshafts has started for one Indian OEM, with a second, larger-volume program planned for the next year.

- Market Position: PCL emphasized that it has not lost any business or market share with customers globally despite the downturn.

- Subsidiary Performance:

- MEMCO (India): Reported breakeven margins with total income of Rs. 10.7 crores and a net profit of Rs. 0.05 crores, affected by an industry slowdown.

- EMOSS (Netherlands): Faced challenges due to an economic slowdown in Europe, subsidy reductions, and geopolitical instability, resulting in revenue dropping to Rs. 12.7 crores from Rs. 17 crores in the prior quarter.

- MFT (Germany): Stabilized operations with sales of Rs. 28.5 crores, focusing on diversifying its product portfolio with non-engine components.

- EV Business:

- India: Commercial sales of electrified vehicles began in August 2024 across logistics, e-commerce, and waste management sectors. However, volume ramp-up has been slower than expected. PCL is also working on customer-driven heavy vehicle electrification projects, with details to be disclosed later.

- Europe: Severe economic challenges and subsidy pullbacks have impacted EMOSS, with recovery not expected until early 2026.

- Outlook:

- Despite challenges, particularly in Europe affecting export sales, PCL remains resilient and committed to driving growth across its portfolio. The company is navigating both opportunities and headwinds with a focus on long-term value creation.

Question-and-Answer Session: Detailed Management Responses

- EV Business Status and Outlook (Gautam Rajesh, Leo Capital):

- Europe: The EV business (via EMOSS) is struggling due to declining demand, subsidy reductions, and high interest rates amid ongoing conflicts. Recovery is projected for early 2026, with no significant upswing expected in the next 9-12 months. However, PCL has not lost customers, and timelines for new projects have been deferred by about a year.

- India: The Tata Ace electrification project is gaining traction, with engagements in solid waste management, biomedical waste, e-commerce, and logistics. Retrofitting older vehicles is complex due to state-wise regulations, but demand is slowly increasing. Heavy vehicle electrification is a key focus, with customer-driven projects underway and initial vehicles expected on roads within two quarters.

- EV Infrastructure and Capacity Utilization (Rajkumar Damania, 369 Advisor Services):

- Infrastructure: PCL supplies vehicles with chargers (compatible with 15-amp sockets) and has partnered with a nationwide service provider for EV maintenance, avoiding the need to build charging infrastructure itself.

- Coverage: Vehicles have been supplied to 7-8 cities (e.g., Kolkata, Delhi, Hyderabad, Solapur, Pune, Mumbai), with engagements across 20-30 cities targeting fleet owners for government contracts.

- New Capacity (Camshafts): Two new plants are being equipped for projects starting in late 2025 or 2026, primarily for assembled camshafts as import substitutions for Indian and international OEMs. Full capacity utilization (70,000-80,000 units/month) is expected within 1.5 years, with buildup over the next 8-10 months.

- Segmental Reporting: Machining and casting camshaft revenues are already in the investor presentation; EV retrofit revenue reporting will begin once volumes justify it.

- Volume Drop and Subsidiary Performance (Vipul Shah, Sumangal Investments):

- Camshaft Volume Drop: The 13% decline is due to reduced demand in Europe, Brazil, and Mexico, with India flattish and the U.S./Korea/Uzbekistan stable. This aligns with OEMs reducing inventory, not a loss of market share. Domestic vs. international sales split is roughly 50:50.

- Subsidiaries: Despite profitability challenges, PCL is not considering disinvestment due to poor market conditions in Europe. The focus is on self-sufficiency, scaling operations to match current order books. EMOSS was profitable previously but is now impacted by external factors.

- Assembled Camshafts: The new plant targets 50,000-70,000 units/month, offering slightly higher EBITDA margins due to costlier materials and advanced machining, with minimal risk as it’s for a running engine with a familiar customer.

- Import Substitution and EV Trajectory (Shagun Jain, Individual Investor):

- Import Substitution: Focused on the Indian market, leveraging PCL’s 70%+ market share in passenger vehicles to replace imports for Indian OEMs. More such projects are being explored.

- PV Slowdown: No significant uptick is expected in Q1/Q2 2025, though new projects (camshafts and assembled camshafts) will boost revenue from mid-2026 (FY ’27).

- EV in India: Commercial sales started five months ago (August 2024), with a slow but widening customer base. Heavy vehicle electrification is promising, with higher profitability potential (e.g., 300 kWh battery packs vs. 10-15 kWh for LCVs).

- Strategic Focus and Revenue Timeline (Ketan Chheda, Individual Investor):

- Market Share: PCL holds about 70% of the Indian passenger vehicle camshaft market.

- EV Strategy: LCV electrification is streamlined (99% localized, competitive ROI <2 years), allowing focus on heavy vehicles, driven by customer demand. This leverages EMOSS technology but adapts it for Indian vehicles (e.g., Tata, Ashok Leyland).

- Revenue Timeline: LCV retrofit revenue (crores of rupees) is ongoing, with heavy vehicle revenue expected from CY ’26. Retrofitting is currently done in Solapur and Pune, expandable to other locations as demand grows.

- Heavy Vehicle Retrofitting Economics (Vipul Shah, Follow-up):

- Technology: Sourced from EMOSS but localized from the first vehicle for Indian models (e.g., Bharat Benz, Eicher).

- Economics: ROI remains 2-3 years, similar to LCVs. Reported under PCL standalone currently.

Closing Remarks

Mr. Shah expressed gratitude to participants, hoping their queries were addressed, and looked forward to continued engagement in the next quarter’s call, reinforcing PCL’s commitment to transparency and stakeholder communication.