The global semiconductor industry is on the cusp of a massive transformation. Projections indicate that the market, currently valued at around USD 627 billion in 2024, could expand to nearly USD 1.03 trillion by 2030. This growth is driven by unprecedented demand across artificial intelligence, 5G and 6G, electric vehicles, cloud computing, defence electronics, and the Internet of Things.

For India, the semiconductor opportunity is more than just about global supply chains — it is about reshaping its role in the technology economy. With government incentives, policy support, and an ecosystem rapidly forming around chip design, manufacturing, packaging, and testing, India is positioning itself as a serious contender in the trillion-dollar race.

Indian Companies Positioned to Benefit

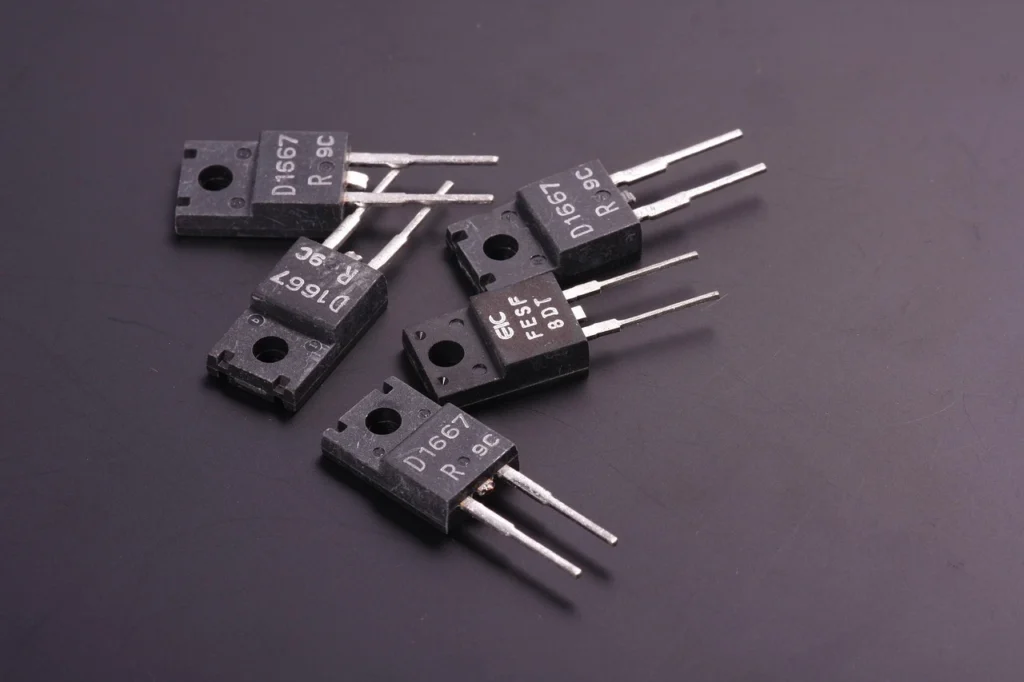

Several Indian listed companies stand to gain directly from this semiconductor boom. Firms engaged in electronic design services, outsourced semiconductor assembly and testing (OSAT), electronics manufacturing services (EMS), and defence electronics are poised to see strong order inflows.

- Design and Verification Players: Tata Elxsi and MosChip Technologies provide semiconductor design, ASIC development, and verification services.

- EMS and Hardware Manufacturing: Dixon Technologies and Syrma SGS Technology are key players in electronics manufacturing services.

- OSAT Specialists: SPEL Semiconductor and CG Power & Industrial Solutions are emerging as leaders in packaging and testing.

- Defence and Communication Electronics: Bharat Electronics Ltd (BEL) could be a significant beneficiary as semiconductor use in aerospace and defence rises.

- Diversified Conglomerates: Vedanta and the Tata Group have announced large-scale semiconductor projects that could reshape the industry if executed successfully.

Ancillary Beneficiaries: The Secondary Winners

The semiconductor story is not only about chipmakers and assemblers. A broader set of industries will benefit as the ecosystem scales in India.

- Specialty Chemicals: Navin Fluorine, SRF, and Gujarat Fluorochemicals supply essential chemicals for chip fabrication.

- Industrial Gases: Linde India and INOX Air Products provide high-purity gases critical for cleanroom operations.

- Precision Equipment & Automation: Honeywell Automation India and Thermax are well-placed to supply cleanroom solutions and process automation.

- Power & Infrastructure Providers: ABB India, Siemens India, and KEC International may benefit from power, water, and infrastructure requirements of semiconductor fabs.

Implications for the Indian Share Market

- Re-rating of Semiconductor-Exposed Stocks

Valuation upgrades are likely for firms linked to chip design, EMS, and OSAT. - Capex-Driven Growth Stories

Companies with strong execution and access to incentives will attract institutional investors. - Broader Market Spillovers

Ancillary suppliers in chemicals, automation, and industrial gases could quietly outperform. - Policy as a Catalyst

Government incentives will be critical to separating winners from laggards. - Cyclical Risk Remains

Investors must stay mindful of the global semiconductor cycle.

Key Risks Investors Should Track

- Execution delays in fab and OSAT projects.

- Infrastructure bottlenecks in power, water, and manpower.

- Global competition from other emerging markets.

- Currency volatility and import dependency for tools and raw materials.

Top 10 Indian Semiconductor & Ancillary Stocks to Watch

- Tata Elxsi – Semiconductor design and verification services

- MosChip Technologies – ASIC and embedded systems development

- Dixon Technologies – Electronics manufacturing services

- Syrma SGS Technology – Hardware and component manufacturing

- SPEL Semiconductor – Outsourced packaging and testing (OSAT)

- CG Power & Industrial Solutions – New OSAT facility in Gujarat

- Bharat Electronics Ltd (BEL) – Defence and communication electronics

- Vedanta Ltd – Large-scale semiconductor manufacturing plans

- Navin Fluorine – Specialty chemicals for chip fabrication

- Linde India – Industrial gases for semiconductor manufacturing

Conclusion

The trillion-dollar semiconductor projection is not just a global milestone — it could be a defining moment for Dalal Street. From design houses and EMS providers to OSAT specialists and ancillary suppliers, India is gearing up to capture a slice of this massive growth.

For investors, this is a multi-year theme. Identifying credible companies with execution capability, strong balance sheets, and government support could mean riding the next wave of wealth creation in India’s markets.