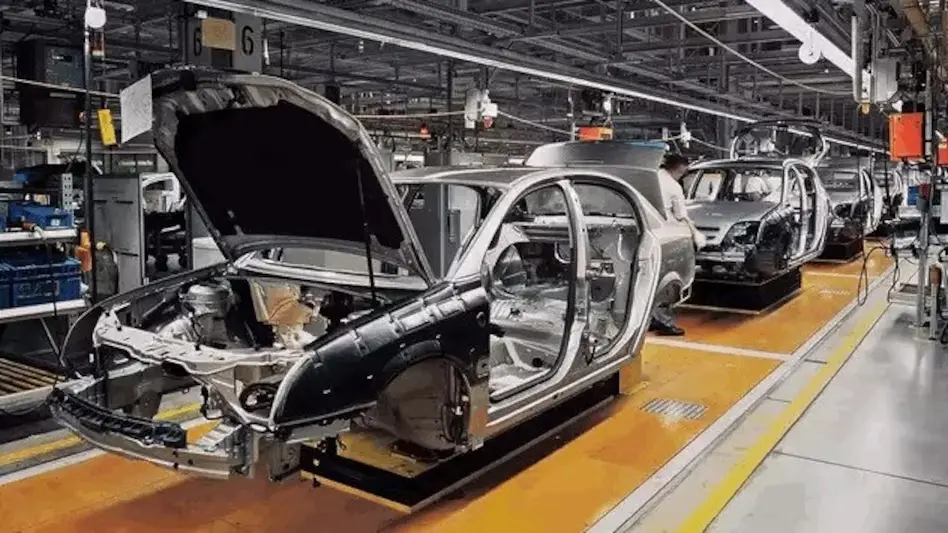

India’s auto-component industry is gearing up for a transformative decade. By 2030, the sector is expected to reach a size of around $200 billion, nearly doubling from its current levels. This growth will not just be a manufacturing milestone but also a significant driver of wealth creation in the Indian stock market. For investors, this industry represents one of the most compelling long-term opportunities, spanning large-cap stability, mid-cap growth potential, and selective small-cap plays in high-tech niches.

A Market on the Move

The journey to $200 billion is fueled by a combination of domestic consumption, export expansion, and the transition to new technologies:

- Domestic Demand: India remains one of the fastest-growing automotive markets globally, with rising household incomes, increasing urbanisation, and a young demographic profile pushing vehicle sales higher.

- Electrification of Mobility: The EV revolution is creating new demand for motors, battery management systems, sensors, and lightweight alloys. Auto-component makers are aligning their strategies to cater to this shift.

- Export Expansion: As global OEMs diversify supply chains, India is emerging as a preferred destination. By 2030, exports could form a large share of total industry revenues, providing scale and stability.

- Policy Push: Incentives under the government’s production-linked schemes and focus on localisation are encouraging domestic value addition and technology investments.

These structural drivers ensure that the industry’s growth is not merely cyclical but also anchored in long-term fundamentals.

Beneficiaries in the Stock Market

Not every company will benefit equally from this transformation. Some listed players are better placed to capitalise on scale, technology, and export-led growth.

- Motherson Group Companies: With global supply chains, diversified products, and a strong domestic footprint, they are among the largest beneficiaries of both local growth and export opportunities.

- Bosch India: With its strength in automotive electronics, powertrains, and EV-related systems, Bosch is poised to gain from the increasing electrification of vehicles.

- Bharat Forge: Already a leader in forging and engineering, the company is investing in EV-specific components and lightweight structures.

- Sundram Fasteners: A long-standing name in fasteners, engine parts, and EV-friendly products, the company has significant upside linked to two-wheeler and passenger vehicle volumes.

- Endurance Technologies: Strong in two-wheeler and three-wheeler components, the company is steadily adding EV-related products to its portfolio.

- Varroc Engineering: Specialising in lighting and electronics, Varroc stands to benefit as vehicles become more advanced and tech-integrated.

Beyond these leaders, several mid- and small-cap firms with niche specialisations — such as steering systems, braking components, and advanced materials — may also see re-ratings as they win new contracts.

Export Power: The Game-Changer

Exports could become the biggest growth multiplier for the industry. Indian companies are increasingly supplying to global automakers in Europe, the US, and Southeast Asia. The shift away from China in global sourcing is opening new opportunities, and Indian firms with competitive costs, strong engineering, and reliable supply chains are stepping in. This export momentum could help listed companies not only scale revenues but also expand margins due to larger order volumes and currency tailwinds.

EVs and New-Age Mobility

The transition to EVs is both a challenge and an opportunity. Traditional components linked to internal combustion engines may see slower growth, but the rise of EV-specific components — such as battery packs, motors, and electronic control systems — will offset this decline. Companies that have already begun investing in EV technologies are likely to secure early-mover advantages, while laggards risk obsolescence. For investors, EV-linked revenue share is a key metric to track.

Investor Playbook

For market participants, the auto-component theme offers multiple layers of investment strategies:

- Core Large-Cap Exposure: Established leaders with global footprints and diversified product portfolios provide stability and consistent compounding.

- Growth Mid-Caps: Companies scaling fast in exports or EV components could deliver strong earnings growth and higher stock market re-ratings.

- Selective Small-Caps: Firms with niche intellectual property, such as sensors or advanced alloys, offer high risk–high reward opportunities for investors with a longer horizon.

Risks to Monitor

While the growth trajectory is strong, investors should remain mindful of potential headwinds:

- Commodity Price Volatility: Fluctuations in steel, aluminium, and rare-earth materials could impact margins.

- Execution Challenges: Not all firms may meet localisation and PLI requirements on time, leading to delays in scaling.

- Technological Disruption: Companies that fail to pivot quickly to EVs and digital mobility risk losing market share.

- Global Trade Uncertainties: Export growth could face temporary setbacks due to geopolitical tensions or supply chain disruptions.

The Road Ahead

Over the next 12–18 months, investors should track company updates on new export contracts, EV revenue contributions, and production-linked scheme benefits. Rising earnings visibility, improving order books, and higher average selling prices (ASP) for advanced modules are likely to drive stock market valuations higher.

Conclusion

India’s auto-component industry is not just expanding in size; it is evolving in sophistication, technology, and global relevance. With the sector expected to reach $200 billion by 2030, listed companies in this space represent a powerful long-term investment story. From large-scale leaders to niche innovators, the beneficiaries are diverse, offering investors a wide array of opportunities. For the Indian share market, this is not just a cyclical upswing — it is a structural growth wave that could deliver strong wealth creation over the coming decade.