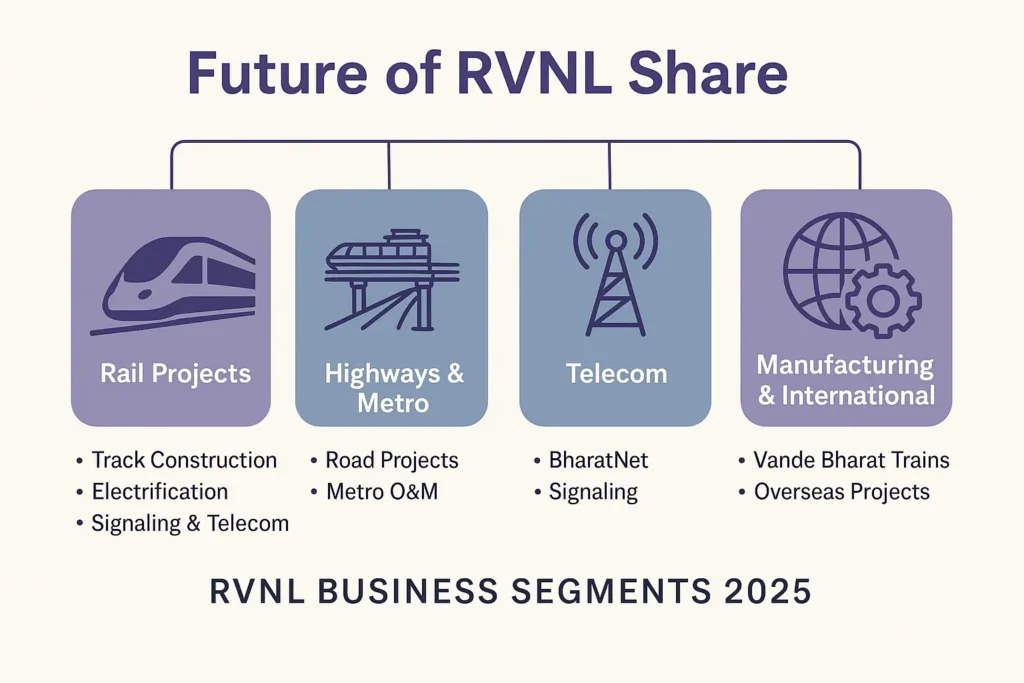

Rail Vikas Nigam Limited (RVNL), a Central Public Sector Enterprise under the Ministry of Railways, has long been a key player in India’s railway infrastructure development. However, RVNL today is no longer just a rail-centric executor of government-assigned projects. It is undergoing a transformational shift toward becoming a multi-sector, competitive bidding-based infrastructure powerhouse, tapping into new verticals like highways, ports, metros, telecom (BharatNet), manufacturing (Vande Bharat trains), and international projects.

This evolution not only expands RVNL’s addressable market but also makes it a strong long-term contender in India’s infrastructure growth story. Let’s delve deep into what makes RVNL a potential multibagger in the coming years.

Strategic Shift in Business Model

RVNL was initially focused on executing infrastructure projects assigned by Indian Railways. These projects were low-risk with stable margins but offered limited scalability. In recent years, RVNL has moved decisively into competitive bidding across diverse infrastructure segments.

CMD Pradeep Gaur stated, “RVNL is now transitioning from an assigned work model to competitive bidding in railways, highways, ports, metros, telecom, and even international markets.”

This shift is critical as the assigned railway project pipeline is gradually shrinking (from ₹1.15 lakh crore to ₹45,000 crore). However, the bidding-based order book now exceeds the legacy book, indicating successful de-risking and scalability.

Robust Order Book and Future Revenue Visibility

As of FY25-end, RVNL boasts a diversified ₹1 lakh crore order book, with nearly 55% from competitive bids. Here’s a breakdown of the current portfolio:

| Segment | Order Value (₹ Cr) | Remarks |

|---|---|---|

| Assigned Railway Projects | 45,000 | Depleting legacy orders |

| Bidding-Based Projects | 55,000 | Fast-growing; cross-sector |

| Vande Bharat JV | 9,640 | Manufacturing; revenue to begin FY27 onwards |

| BharatNet (Telecom) | 14,000 | Includes ₹7,000 Cr capital + ₹7,000 Cr O&M |

| International Projects | 4,000 (current) | Targeting 2–3x growth in FY26 |

| Civil Infra (Metro, Roads) | 9,500 | Competitive bidding projects |

| Power & RDSS Projects | 9,490 | Mostly last-mile electrification |

| Telecom & Signaling (S&T) | 9,000 | Incl. automation, signalling, telecom networks |

The order inflow in FY25 stood at ₹14,000 crore, and management expects 20–25% growth in FY26, targeting ₹17,000–₹18,000 crore.

International Expansion: Global Play for Better Margins

RVNL’s international business is gaining traction, with the management aiming to increase overseas contribution to 40–45% of total order book in the long run. Current bids and opportunities include:

- Albania: ₹3,500 crore railway project (bidding underway)

- Peru: Planning, design, and advisory roles

- Middle East: Bids in Oman, UAE, and Saudi Arabia

- Uzbekistan: Renewable and electrical infra

International projects typically offer better margins and long-term viability, positioning RVNL as a globally competitive player.

The Vande Bharat Opportunity: Manufacturing Revenue from FY27

One of RVNL’s most exciting ventures is its joint venture to manufacture sleeper versions of Vande Bharat trains. Production will begin in June 2026 from the Latur facility, with revenues kicking in from FY27.

- Number of trains: 120 sets

- Cost per train: ₹120 crore

- Production cost: ~₹95–97 crore

- Estimated project size: ₹14,400 crore

RVNL has already placed procurement orders and expects to begin assembly by June 2025. Since the core design is ICF-based, trials will be relatively quick, enabling revenue realization in 2026-27.

BharatNet and Emerging Sectors: Creating Long-Term Revenue Streams

RVNL is the largest PSU player in BharatNet Phase II, contributing to rural broadband infrastructure. The total order value is ₹14,000 crore, including 7 years of operation & maintenance.

Additionally, RVNL is exploring high-margin, long-term revenue opportunities in:

- Metro O&M contracts (already bidding in 7 cities)

- Battery Energy Storage Systems (BESS) for solar-powered railways

- Small Modular Nuclear Reactors (SMRs) aligned with India’s clean energy targets

- Data centers as a new infra vertical

These moves indicate a shift from capex-only to annuity-type models, ensuring predictable cash flows and stable margins.

Financial Strength and Operational Resilience

Despite the temporary revenue dip in FY25 due to fund delays from the Railways (received ₹19,000 Cr vs. required ₹23,000 Cr), RVNL remains fundamentally strong:

- FY25 turnover: ₹19,500 crore

- FY26 guidance: ₹21,000+ crore

- Debt-free with low-cost guarantees (0.05–0.1%)

- Net margin focus: Despite cut-throat EPC competition, RVNL is innovating to retain or improve margins through new verticals and cost controls

The company has also restructured its workforce, rightsizing from 1,221 in FY24 to 1,042 in FY25, while onboarding experts in solar, highways, and metro O&M to match its evolving portfolio.

Challenges to Watch

While RVNL’s prospects are strong, investors should monitor these challenges:

- EPC competition: Unrealistic bids from competitors (-20% to -30%) pressure margins

- Execution risks: Especially in international or first-time sectors (e.g., data centers)

- Working capital strain: Bidding projects require more upfront capital than assigned projects

- Geo-political risk: Overseas expansions depend on regional stability (e.g., Middle East, Balkans)

Market Performance and Investor Sentiment

As of July 2025, RVNL’s stock has shown strong YTD performance backed by robust earnings commentary and expansionary announcements.

- Market Cap: ₹30,000+ crore

- P/E Ratio: Reasonable vs peers like IRCON, RITES

- Dividend Yield: Attractive for PSU investors

- Retail & DII interest: On the rise due to Vande Bharat, BharatNet, and global bids

Conclusion: Is RVNL a Good Long-Term Investment?

Absolutely, yes — but with a caveat.

RVNL’s transformation into a diversified, future-ready infra enterprise positions it well for multi-decade growth. With an expanding order book, entry into high-margin segments, international expansion, and a clear focus on execution and efficiency, RVNL is not just riding India’s infrastructure boom — it is helping drive it.

For long-term investors, particularly those seeking exposure to India’s railway modernization, digital infra, and clean energy mission, RVNL offers a compelling story. However, investors should keep an eye on competitive intensity in EPC and execution timelines in new sectors.

Info Section: Key Concepts Explained

1. EPC (Engineering, Procurement, Construction):

A project model where a company takes end-to-end responsibility — from planning to execution. Competitive but margin-sensitive.

2. Assigned Projects vs Bidding Projects:

Assigned: Direct work orders from Indian Railways.

Bidding: Projects won through tenders; more competitive but scalable.

3. RDSS (Revamped Distribution Sector Scheme):

A Government of India scheme to modernize electricity distribution networks.

4. BharatNet:

India’s largest rural broadband initiative to connect every village via high-speed internet.

5. Vande Bharat Trains:

Semi-high-speed trains manufactured indigenously, known for speed, comfort, and reliability.

6. O&M Contracts:

Operation and Maintenance contracts offer recurring revenue from long-term service agreements.

7. Joint Venture (JV):

A strategic partnership between RVNL and another entity to share ownership, risks, and returns in a project.