Growth Strategy

- Strategic Acquisitions and Expansion

- Acquired Sunbeam Auto Pvt. Ltd., DR Axion, and Fronberg Germany to strengthen its market presence.

- Invested in new greenfield projects, including alloy wheel plants at Bhiwadi and Hosur.

- Aims to become a leading supplier in the automotive and industrial engineering sectors.

- Diversification of Revenue Streams

- Transitioning from a 2-wheeler-focused aluminum segment to a 4-wheeler dominant business.

- Entering the structural parts and alloy wheel segments to reduce dependency on internal combustion engine (ICE) components.

- Capacity Expansion and Technological Advancements

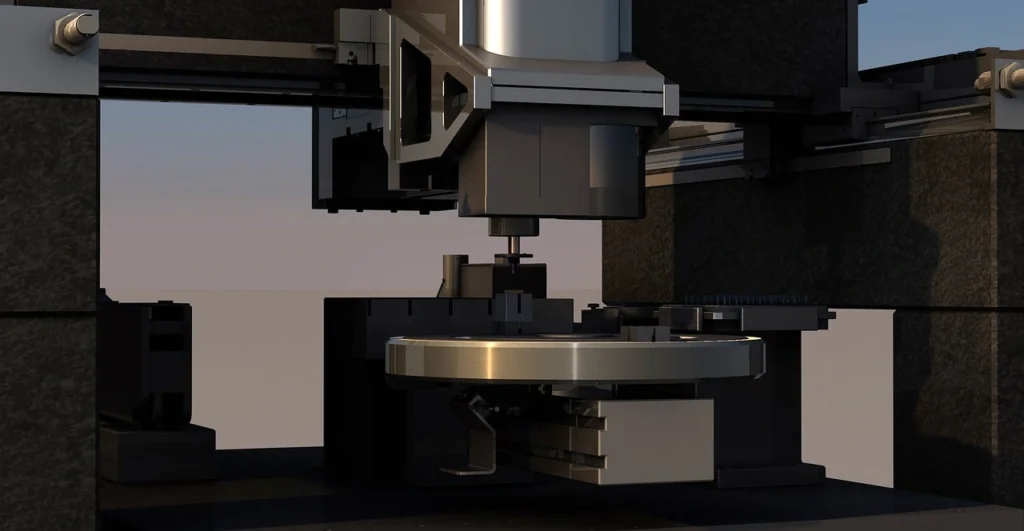

- New machining capacities for large engine blocks, including V12, V16, and V20 engines.

- Setting up foundries and machining centers for high-precision components.

- Enhanced Operational Efficiencies

- Consolidation of manufacturing plants to reduce costs.

- Focus on automation in storage solutions and engineering processes.

Future Outlook

- Revenue and Profitability Growth

- Projected revenue to grow from INR 5,500 crores in FY 2024-25 to INR 7,000 crores in FY 2025-26.

- EBITDA expected to rise from INR 850 crores to INR 1,100 crores, with margin improvement as projects stabilize.

- Expanding International Presence

- Fronberg Germany acquisition positions the company as a global supplier for stationary engine components.

- Increasing exports and partnerships with global players.

- Scaling the Powertrain and Stationary Engine Business

- Investments in large-scale stationary engine components to capture the rising demand from data centers and power generation.

- Targeting revenue of $100 million from this segment by FY 2028-29.

- Strengthening Alloy Wheel Business

- Bhiwadi and Hosur plants expected to contribute INR 800 crores in revenue by FY 2027.

- Full capacity utilization of these plants anticipated in the next two years.

Challenges

- High Initial Costs and Debt Burden

- Recent investments have increased debt-to-EBITDA to 2.24x, which is expected to decrease post-Gurgaon land sale.

- Heavy upfront costs in new plants, affecting short-term margins.

- Execution Risks

- Long gestation period (18-24 months) for new product development, especially in stationary engine components.

- Integration of acquisitions like Sunbeam and DR Axion without operational disruptions.

- Market and Industry Risks

- Slower-than-expected adoption of new capacities due to demand fluctuations.

- Continued reliance on ICE components in Powertrain, though diversification is in progress.

- Global and Domestic Economic Factors

- Fluctuating raw material prices impacting profitability.

- Competition from domestic and international players in the automotive and engineering industries.

Key Advancements

- Infrastructure and Manufacturing Upgrades

- Rapid setup of Bhiwadi alloy wheel plant within eight months, showcasing execution efficiency.

- New foundry at Kothavadi for stationary engine components.

- Technological Enhancements

- Adoption of advanced automation and AI-driven storage solutions.

- Integration of Sunbeam’s expertise to enhance manufacturing efficiencies.

- Expansion of Client Portfolio

- Increased engagement with global players in the stationary engine market.

- Strong order book in the alloy wheel and Powertrain segments.

Is Craftsman Automation a Good Buy?

Pros:

- Strong growth potential with revenue and EBITDA expansion plans.

- Well-diversified portfolio across automotive, industrial, and engineering sectors.

- Strategic acquisitions and capacity expansions providing long-term value.

- Debt levels expected to decrease with Gurgaon land sale and profitability improvement.

Cons:

- Short-term financial pressure due to high capex and integration costs.

- Market risks related to ICE transition and economic fluctuations.

- Execution risks in ramping up new facilities and acquisitions.

Investment Verdict:

Craftsman Automation presents a compelling long-term growth opportunity due to its strategic investments, expansion into high-margin businesses, and global partnerships. However, short-term volatility and integration risks must be considered. It may be a strong buy for long-term investors but requires patience as the company transitions through its expansion phase.