Sustainable investing, once considered a niche, has now become a defining force in global financial markets. ESG (Environmental, Social, and Governance) strategies are no longer limited to specialized funds—they are now integrated into mainstream asset allocation decisions. According to global estimates, ESG assets are projected to surpass US $40 trillion by 2030, cementing their role as a core component of wealth management and institutional portfolios.

Europe continues to lead the charge, holding nearly 84% of global ESG assets, driven by strict disclosure norms and investor preference for ethical capital allocation. The United States, though politically divided on ESG, still manages about US $300 billion in sustainable assets. Meanwhile, Asia, especially emerging markets like India, is witnessing rapid adoption, making ESG one of the fastest-growing investment trends in the region.

At the sectoral level, green technologies—renewables, electric mobility, hydrogen, smart grids, and carbon capture—are attracting unprecedented inflows. In 2024, global investment in these segments touched US $2.1 trillion, with China alone contributing over US $800 billion, underlining how climate action is reshaping capital flows worldwide.

The Rebound of Green Stocks

After facing headwinds from inconsistent standards and greenwashing concerns, ESG and clean energy investments are staging a comeback. Funds like the VanEck Global Clean Energy ETF have delivered double-digit returns in 2025, drawing back retail and institutional investors alike.

Financial hubs such as London are positioning themselves as ESG capitals, rolling out green bonds and sustainability-linked financing. Similarly, sovereign wealth funds and climate-focused investment pools in the Middle East and Singapore are channeling billions into clean energy infrastructure and emerging-market ESG opportunities.

This revival signals that sustainable finance is not a passing trend, but an integral part of global capital markets.

India’s ESG Revolution

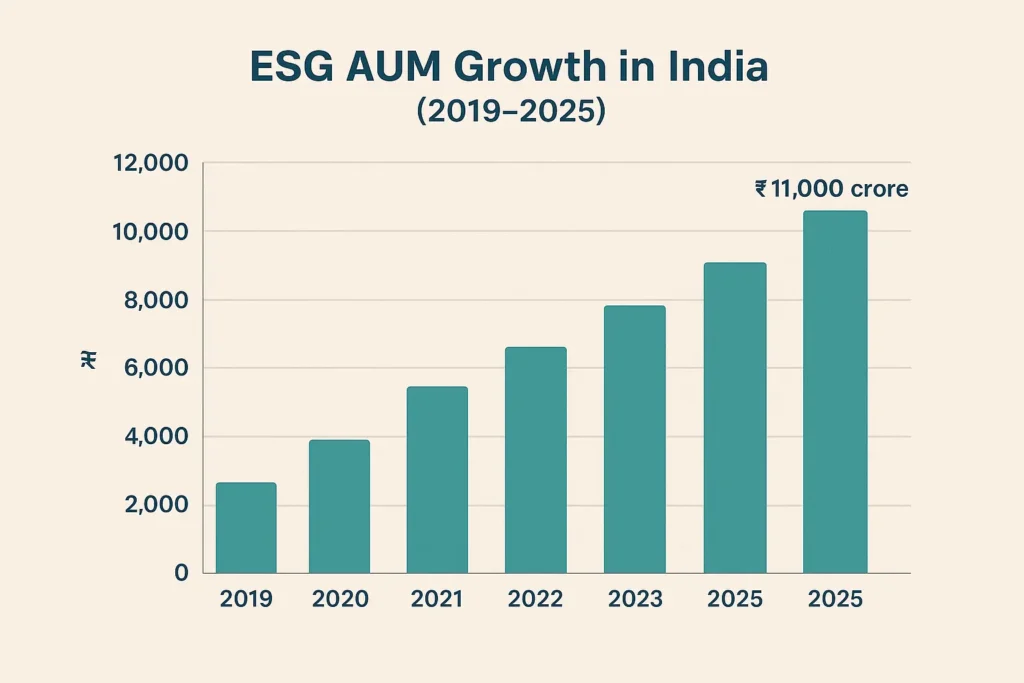

India, one of the world’s fastest-growing economies, is experiencing its own ESG transformation. From ₹2,703 crore in 2019, the Assets Under Management (AUM) of ESG mutual funds have surged to ₹11,000 crore in 2025, a nearly fourfold jump. Industry projections suggest that sustainable investments in India could scale up to US $125 billion by 2026, accounting for nearly 40% of total PE/VC allocations.

This momentum is powered by both policy push and investor demand. The Securities and Exchange Board of India (SEBI) has introduced the Business Responsibility and Sustainability Reporting (BRSR) framework, mandating top listed companies to disclose ESG metrics. Since October 2024, ESG funds must allocate at least 65% to firms providing assured ESG disclosures, publish monthly ESG scores, and undergo annual external audits.

Meanwhile, India’s renewable energy capacity has already crossed 240 GW in 2025, strengthening the case for green financing. Sovereign Green Bonds and sustainability-linked loans are further diversifying the ESG ecosystem. Companies like Infosys, TCS, Wipro, L&T, and Tata Group have publicly committed to carbon neutrality and net-zero goals, positioning themselves as leaders in the ESG transition.

Drivers of ESG Growth in India

- Demographic Tailwinds: With millennials and Gen Z forming the bulk of India’s investor base, there is growing alignment between financial goals and environmental values.

- Risk-Adjusted Returns: Nearly 60% of Indian investors believe ESG funds provide better risk-adjusted performance, compared to just 29% globally.

- Innovation in Financial Products: Green bonds, sovereign bonds, and sustainability-linked loans are offering new avenues for investors.

- Corporate Adoption: Leading listed companies are embedding ESG goals into their strategies, from energy efficiency to governance reforms.

The Road Ahead

The rise of green stocks and ESG investing is not just about ethics—it is about economics. As capital increasingly rewards companies with strong sustainability practices, ESG is becoming a proxy for resilience and long-term competitiveness. For India, which aims to achieve net-zero by 2070, the integration of ESG finance into mainstream capital markets will be critical in balancing growth with sustainability.

Globally, sustainable investing has reached an inflection point. In India, it is set to transform how investors allocate capital, how companies build strategies, and how the financial system contributes to climate action.

For investors, one thing is clear: green is no longer just good for the planet—it’s also good for the portfolio.

Thanks , I have just been looking for info about this subject for ages and yours is the greatest I’ve discovered till now. But, what about the conclusion? Are you sure about the source?

Very interesting details you have noted, thanks for posting. “You bluffed me I don’t like it when people bluff me. It makes me question my perception of reality.” by Andrew Schneider.

I want to show my appreciation to you just for bailing me out of this particular issue. After searching through the online world and coming across ideas which are not helpful, I assumed my life was over. Being alive without the presence of answers to the difficulties you’ve resolved as a result of the website is a serious case, as well as ones which may have adversely damaged my career if I hadn’t discovered your website. That capability and kindness in playing with everything was tremendous. I don’t know what I would’ve done if I hadn’t come across such a stuff like this. I am able to now relish my future. Thank you very much for the specialized and sensible guide. I won’t think twice to suggest your blog post to any individual who ought to have care about this subject matter.

You have observed very interesting points! ps nice website . “It is better to be hated for who you are than to be loved for what you are not.” by Andre Gide.

Sweet site, super design and style, very clean and employ pleasant.